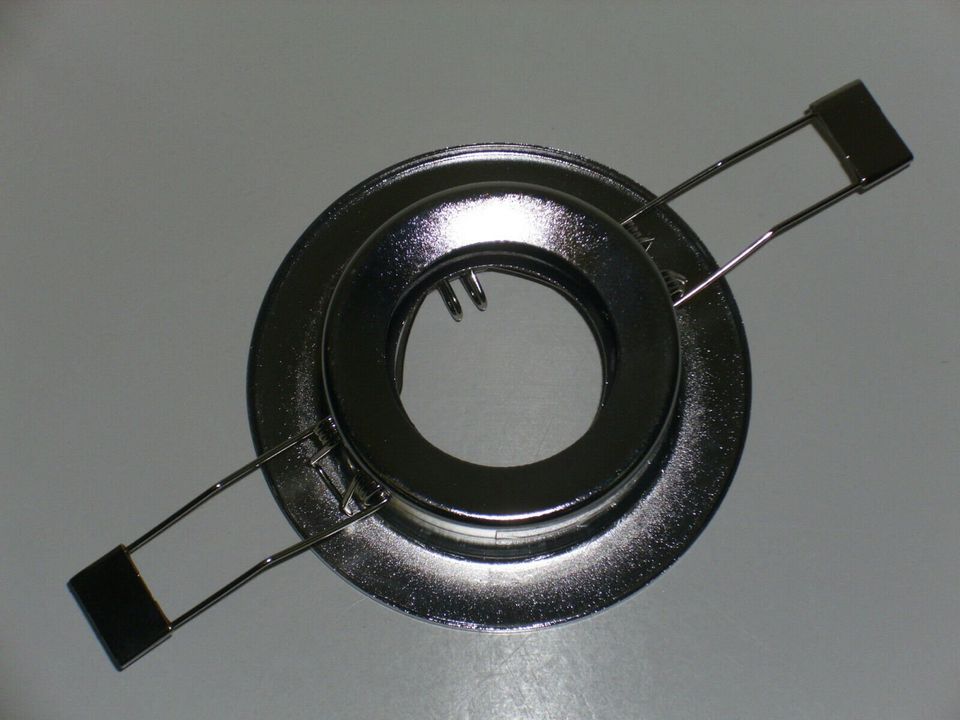

11 Decken Einbaurahmen schwenkbar für MR11+Fassung 12V 1St. 2,00€ in Nürnberg (Mittelfr) - Aussenstadt-Sued | Lampen gebraucht kaufen | eBay Kleinanzeigen

LED-Line LED Einbaustrahler »Einbaustrahler Einbaurahmen Ø55-60mm Bohrloch inkl. GU5.3 Fassung für LED Leuchtmittel 35mm LED Lampen G4 MR11 MR16, Chrome Eckig«

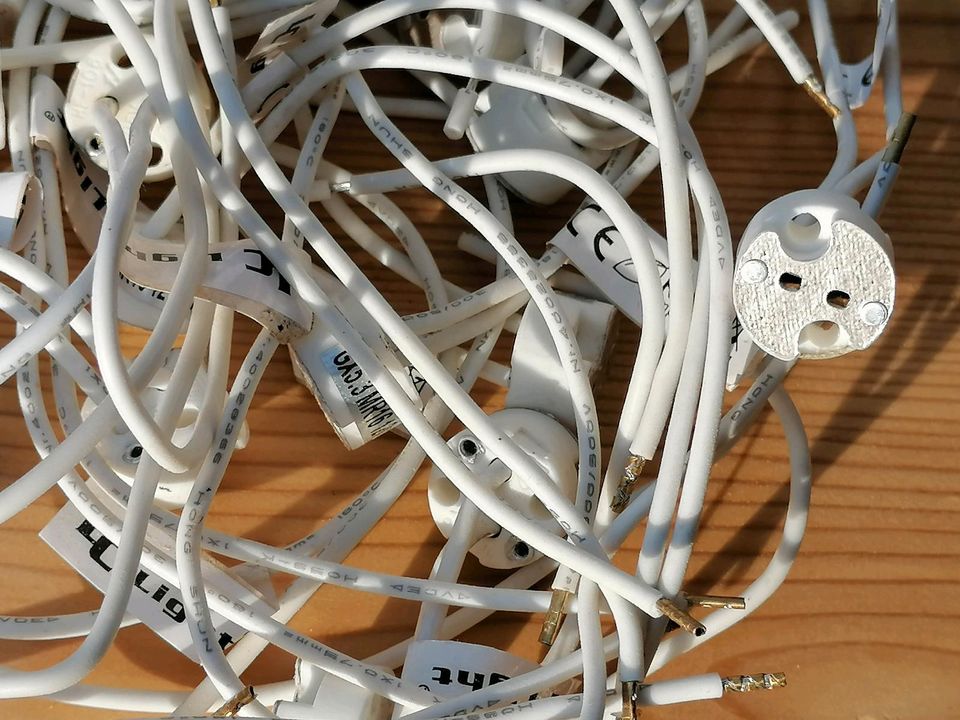

Fassung Sockel MR16 GU4 G4 GU5.3 MR11 NEU 22 Stück in Bayern - Ingolstadt | Lampen gebraucht kaufen | eBay Kleinanzeigen

LED Line® Einbaustrahler Einbaurahmen Ø50mm Bohrloch Eisen inkl. GU5.3 Fassung für LED Leuchtmittel 35mm LED Lampen G4 MR11 MR16, Weiß Rund